1st Aug,2023

I recently wrote a blog on the ‘Pygmalion Effect’ (https://sandeepsahni.com/the-pygmalion-effect-2/ ) which essentially talks about Expectations, and how they are a self-fulfilling prophecy.

High expectations shape high performance – Low expectations shape low performance.

Pygmalion Effect is named from the Greek myth of Pygmalion, the sculptor who carved a statue of a beautiful woman that he later fell in love with. He became obsessed with the statue and wished that he could find a woman as beautiful as his sculpture to marry. Aphrodite, the goddess of love, granted his wish and turned his sculpture into a woman. Pygmalion’s fixation on the sculpture allowed it to come to life, just as our focus on an expectation can impact the outcome in a given situation.

Under the aegis of Sahayak Gurukul, our CSR arm, to spread personal finance literacy, we also conduct regular events for MFDs, IFAs, Advisors and managers etc. from the fund management Industry on “How to Scale Up your Business.”

After addressing thousands of Advisors, the most surprising aspect from these interactions is that most people in our fraternity who are responsible for guiding investors, do not fully comprehend the power of compounding and what it means for the growth of their own business.

At an Industry seminar recently attended by more than a 1000 advisors/MFDs, there was a leading MFD who talked about his goal of buying a Super Luxury Car, and how he is investing through a SIP to achieve his goal. Other MFDs on different panels, were also talking about their personal goals and were also ‘boasting’ about personal family SIPs and how they are increasing their investment from business surplus every year.

Surprisingly very few were talking about investing in their own business.

Our favourite selling stories are about ‘Don’t Bet against India,’ ‘The chronological Lottery’ India is going to experience, and how we are going to be one of the largest and fastest growing economies in the world and how it will impact the investor wealth.

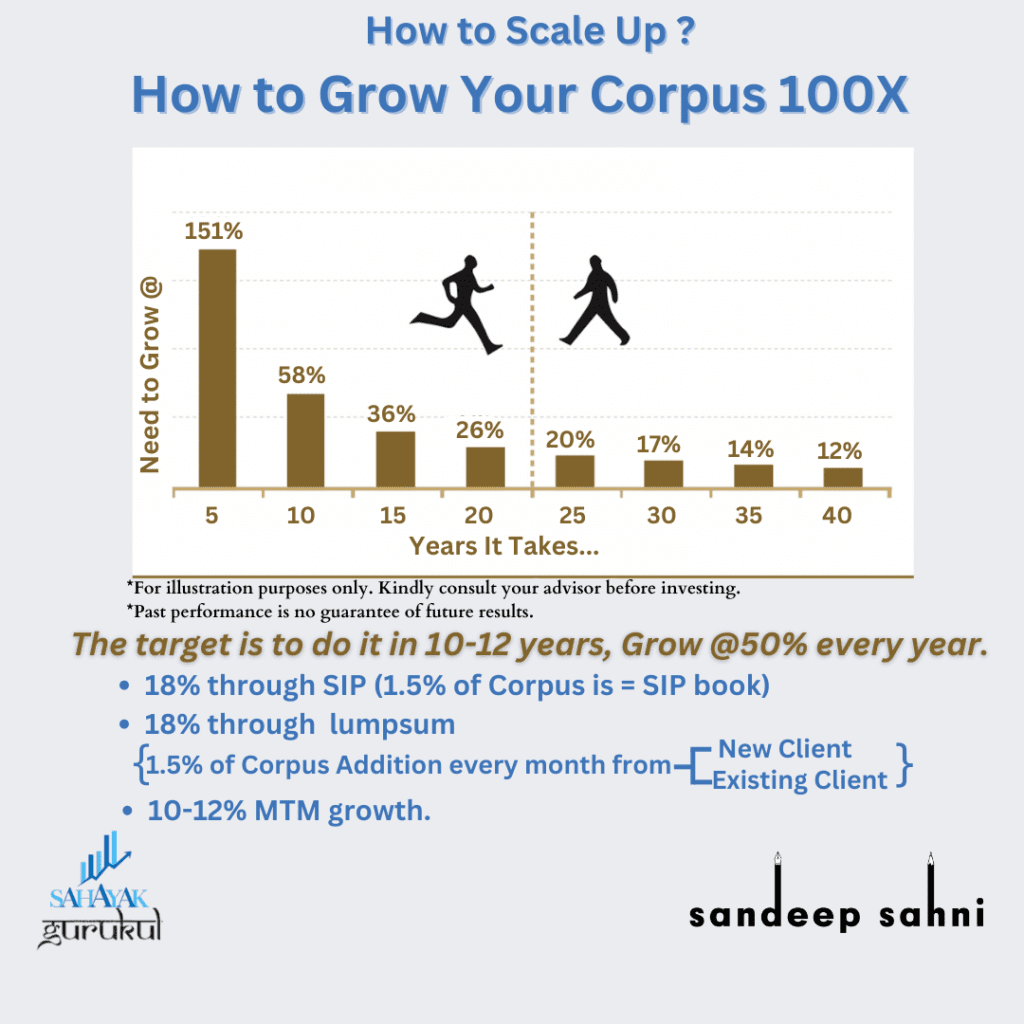

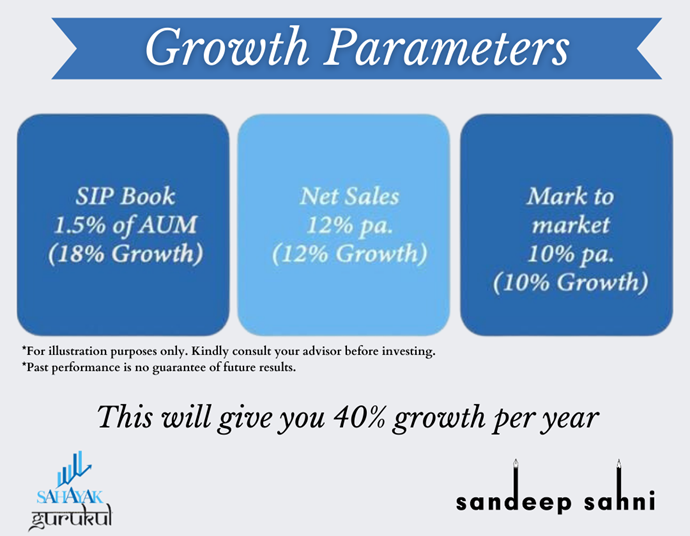

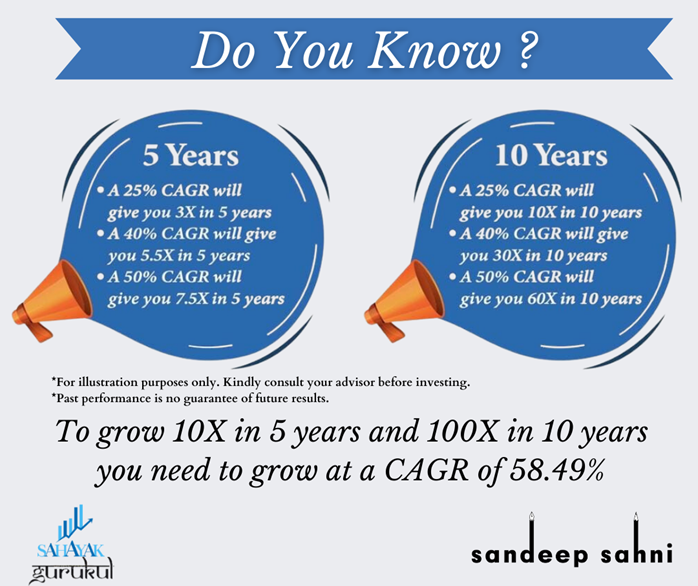

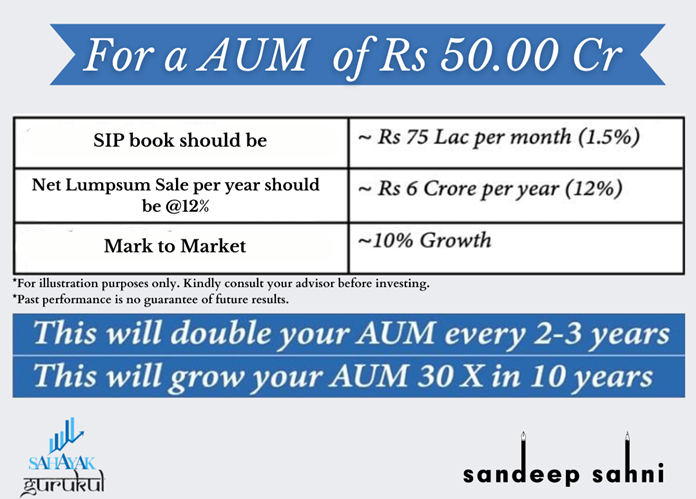

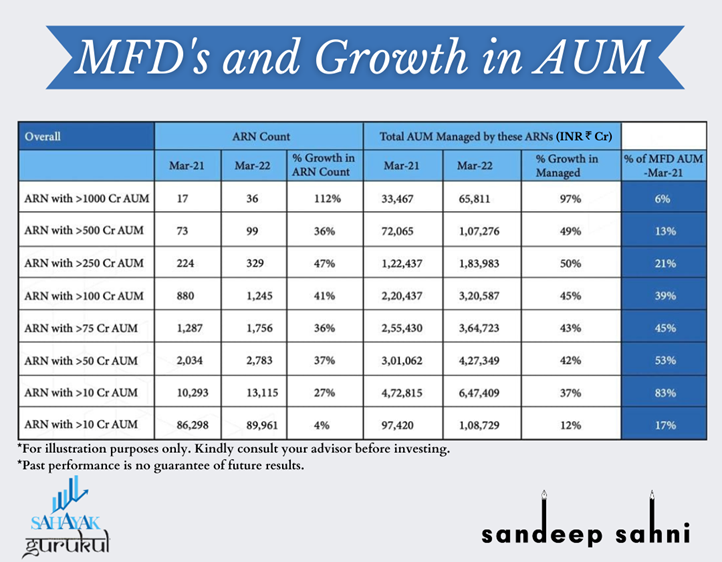

We talk about the impact of compounding @ 12 % or 15% and how investor corpus can grow by 5X, or 10 X etc. etc. but sadly discount our own business growth which can easily grow at a minimum of 36%.

A growth rate of 36% will grow our business 100 X in 15 years and a growth of 58% will make it grow 100 X in 10 years which incidentally also means that your Business income will also grow 100 X in 10 or 15 years.

To achieve that growth, what we need to do is, invest in our business. We must follow a process driven approach, follow SOPs, educate clients, build their conviction in this asset class, and most importantly create our Brand and build a team and upskill it regularly. For all of this, we need to invest in our business.

Investing in a personal SIP will make our investment grow 8-10 X in 15 years but the same amount invested in our business will make it grow 100 X in a similar if not lesser period. The choice is clear.

This MF industry is going to grow, we can’t stop it and the growth is going to surprise many. The choice which all MFDs need to make is whether to participate in this growth as an investor through only personal SIP, or by being a stakeholder in business and reap the benefit of investing in business.

In a country where only 2-3% of the population is investing in equity and MFs contribute to around 10% of GDP as compared to developed nations where a majority of population is investing and MFs contribute to more than 50% of GDP, it is surprising that MFDs are talking about competition and increasing market share rather than increasing the size of the Pie.

As per a study in 2021, titled ‘Mutual Fund Trend’ released by IDFC Mutual Fund, of the total 94500 individual MFDs, 33050 MFDs or 35% of the total individual MFDs manage assets of over Rs.1 crore as on March 2021.

The report further shows that nearly 16,000 MFDs or 17% of the total MFDs have assets under advisory in excess of Rs.5 crore and only 4700 MFDs manage assets in excess of Rs.25 crore.

Friends, there is virtually no competition at the top, just raise the Bar. We are only limited by our own imagination and conviction.

Another MFD attendee in one of our meets, asked a very important question: “In this endless race to grow, How much is enough – Shouldn’t we aim for contentment in our business?”

My answer to that is, if you want contentment, you are in the wrong business.

We make our Clients Dream Big, we teach them compounding, wealth creation and how to be a Billionaire. Thus, it is our Fiduciary responsibility to help them achieve their financial goals and make their journey smooth. We can’t tell them midway, “Boss, I have reached my level of contentment and now you go to someone else.”

Another attendee asked, “Why grow?” and my simple answer to that is ‘Because You Can.’ Our business offers tremendous opportunity, we are at the right place at the right time. (Chronological Lottery) Tremendous wealth is going to be created as India moves from a $3.5 Trillion to a $ 10 Trillion economy in the next 10-12 years. We just need to position ourselves to reap the benefit and if we will not climb the train, someone else will and reach the destination. This train is not going to stop.

If you want to know How to scale up and how to achieve this growth, get in touch with us for a personal session or attend one of ‘Sahayak Gurukul’s’ forthcoming events to know the answers.

Meanwhile, keep learning, keep investing in your business and keep growing – Because you Can!

Happy Investing!

Sandeep Sahni

PS: Even I want to buy a Rolls Royce and it’s my dream car but sadly I still have to start my SIP for this goal as I have a business to invest in and other important goals to take care of first. I am sure the progressive MFD that he is, The MFD with the Super Luxury car goal is also investing in his business and will surely grow his business and personal corpus manifold and achieve his goal too. The mention here was for illustration purpose only and to highlight the significance of investing in our business.

About The author

After completing his schooling from St. Johns, Chandigarh (Class of 1980) and Modern School, New Delhi, (Class of 1982) Sandeep did his B. Com (Hons.) from Shri Ram College of Commerce, Delhi University (Class of 1985)

Sandeep is an alum of IIM Lucknow with a Post Graduate Degree (MBA class of 1988).

He has also written two books, ‘Dear Son, Life Lessons from a Father’ on the teachings of Life https://www.amazon.in/dp/1637815271 and the Second book which he has Co Authored titled, ‘What My MBA Didn’t teach me about Money’ on the Human and Financial perspective of money. https://www.amazon.in/dp/1637816502

He has a rich work experience and started his career as a corporate man with Asian Paints after IIML. He has a rich experience covering the FMCG, Food Distribution, Cold Chain, Logistics, and Hospitality Industries. He is currently in the Wealth Management and Personal Finance domain. He has a passion for finance and is an active speaker on topics in finance. The stories he narrates strike a chord close to his heart, as they are based on events from his own life. He believes in a holistic view of Personal Finance.

Sandeep’s investing experience and study of the Financial Markets spans over 30 years. He is based in Chandigarh and is advising more than 500 clients across the globe on Financial Planning and Wealth Management.

He has promoted “Sahayak Gurukul” which is an attempt to share thoughts and knowledge on aspects related to Personal Finance and Wealth Management. Sahayak Gurukul provides financial insights into the markets, economy and Investments. Whether you are new to the personal finance domain or a professional looking to make your money work for you, the Sahayak Gurukul blogs and workshops are curated to demystify investing, simplify complex personal finance topics and help investors make better decisions about their money.

Alongside, Sandeep conducts regular Investor Awareness Programs and workshops for Training of Mutual Fund Distributors, and workshops and seminars on Financial Planning for Corporate groups, Teachers, Doctors and Other professionals.

Through his interactions and workshops, Sandeep works towards breaking the myths and illusions about money and finance.

His passion has driven him towards career counselling for young adults and mentoring the youngsters on achieving their life goals and becoming “Successful Humans”

He also writes a well-read blog; https://sahayakgurukul.blogspot.com

He has also conducted presentations, workshops and guest lectures at professional colleges and management institutes for students on Financial Planning and Wealth Creation.

He can be reached at:

+91-9888220088, 9814112988,

[email protected]

Follow on:

www.sahayakassociates.in,

www.facebook.com/sahayakassociates,

www.twitter.com/sahayakassociat,https://www.instagram.com/sahayakassociates/

https://sahayakgurukul.blogspot.com, https://www.sahayakassociates.in/resources/our-blog