10th Dec, 2021

In a wonderful book I read recently, Factfulness by

Hans Rosling, he did a small survey and asked some simple questions about Global trends and questions like, what percentage of people around the world are living in poverty,

how many girls in low income countries finish primary school,

what is the life expectancy of the world today and so on.

He proved how we systematically get the answers wrong and a majority gets them wrong irrespective of background, profession, education, etc.

He went on to say that a Chimpanzee choosing answers at random could

outguess journalists, Nobel laureates & investment bankers.

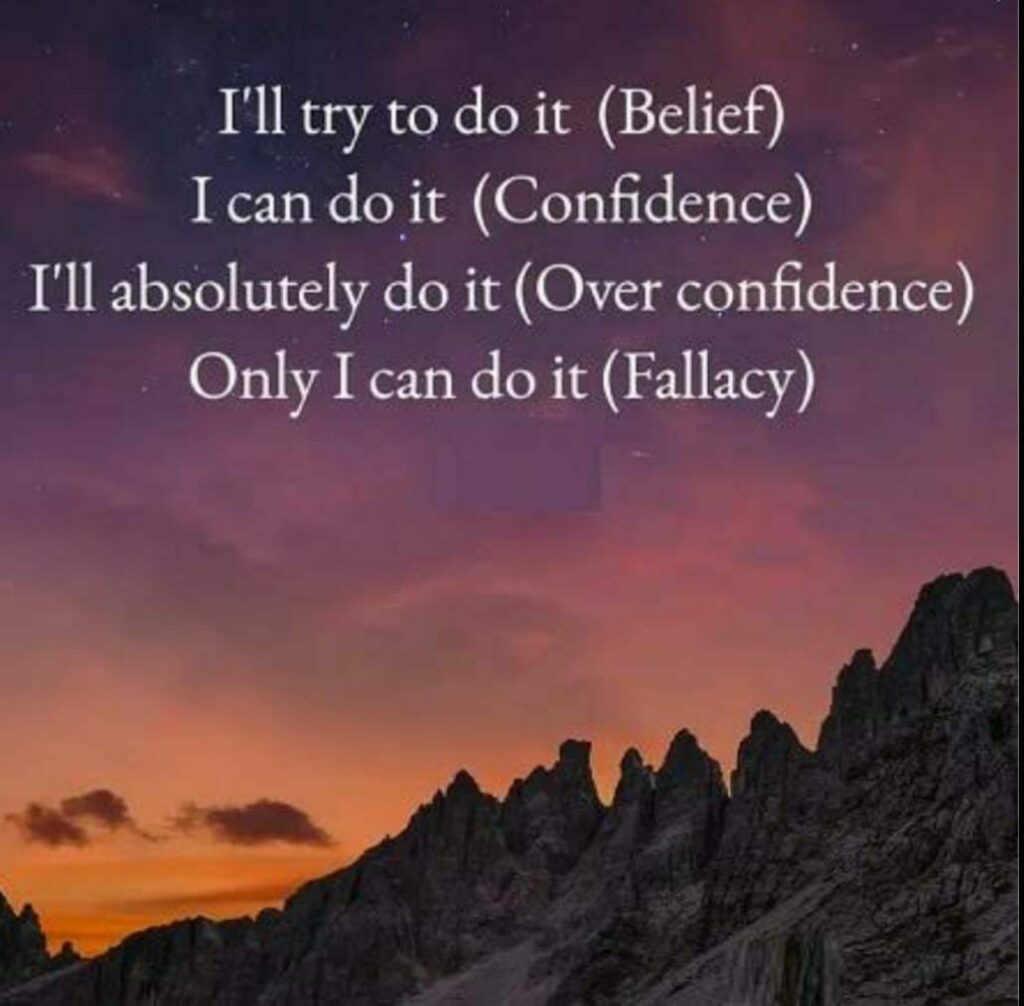

Overconfidence results from the illusion of knowledge, which is the tendency in people to believe that the accuracy of their forecasts necessarily increases with more information.

This however is not necessarily the case, given that information is not the same as insight.

Overconfidence is called “the most significant of the cognitive biases”. The most damaging of biases that affect an individual is overconfidence.

No problem in judgement and decision-making is more prevalent and more potentially catastrophic than overconfidence.

Overconfidence has been the main cause for, among many a disaster right

from the sinking of the Titanic to the subprime mortgage crisis of 2008 and the recession that followed it and many more such disasters.

What’s surprising is that the experts suffer even more from the overconfidence effect than lay people

do.

Let’s say if asked to forecast oil prices in five years’ time, an economics professor will possibly be as wide off the mark as a bus conductor. However, the professor will offer his forecast with a lot of conviction and logic and make us believe in the accuracy of his forecast.

Stephen Hawking rightly said, “The greatest enemy of knowledge is not ignorance but an illusion of knowledge.”

Be wary of the illusion and resultant overconfidence and stay blessed forever.