30th May, 2022

Buridan donkey is a philosophical term or paradox that refers to a hypothetical situation where a hungry and thirsty donkey is placed exactly halfway between a pile of hay and a bucket of water.

Since his hunger is supposed to be equal to his thirst, the donkey is reluctant to eat and drink, and cannot choose either and prefer it at the expense of the other. In theory, it would die of both thirst and hunger as it would be unable to decide which one to get to first and he will not be able to make any rational decision between straw and water.

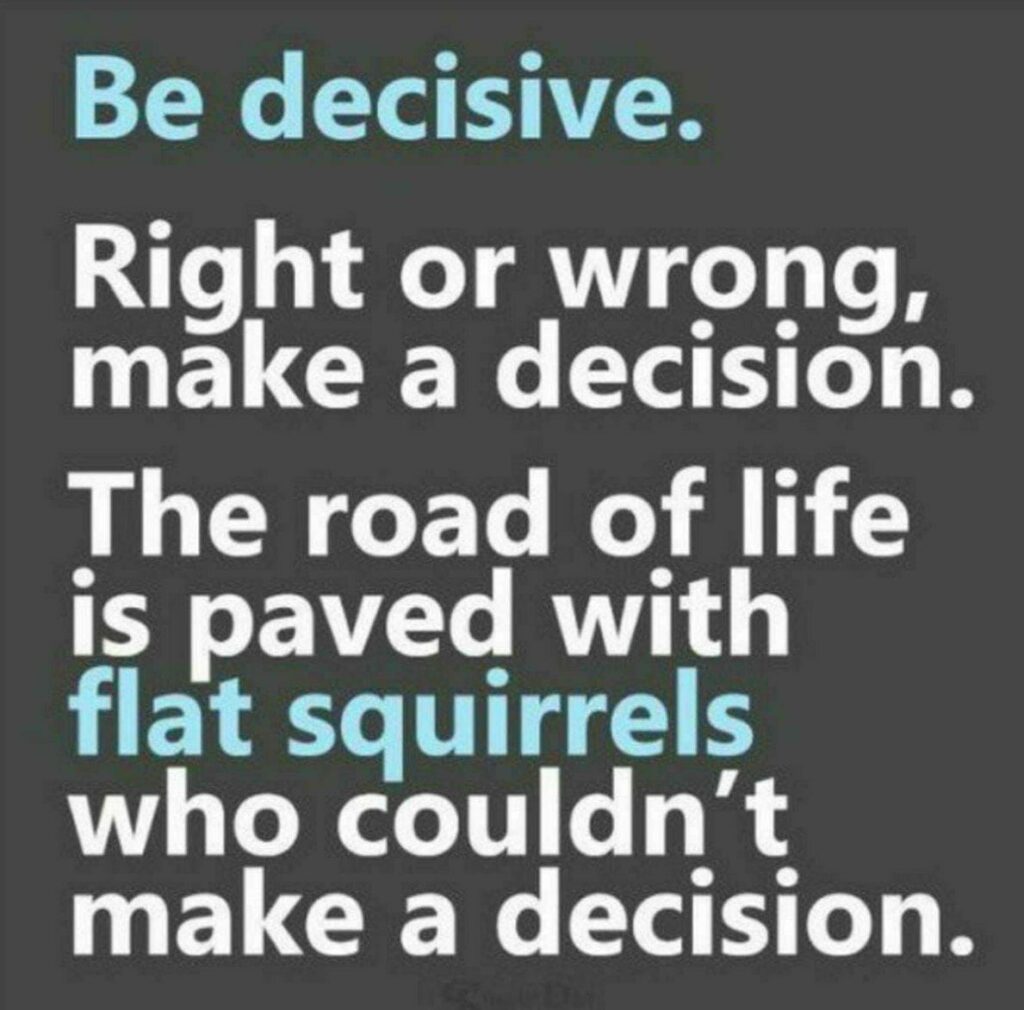

We all face similar situations many times in life and our inability to decide either way ends up with making us lose the opportunity.

The other night my wife asked me, “What do you want to have for dinner, Indian Food or Chinese food?”

It was a simple question, but I had a hard time answering it. In my head Both cuisines had equal weight, and I had no plausible reason to choose one over the other.

Choice is perceived as freedom, but sometimes between a rock and a hard place, or between two roads—both well-treaded, there’s no good way to choose one with proper rationale.

Either there are strong reasons to choose any one of them, or like my case, no particularly strong reason to choose Indian or Chinese food, or vice-versa.

I was stuck. I didn’t know it at that time, But instead of rationale, if we take help from randomness to make a decision here, things can become much simpler.

We can flip a coin and randomly nudge the donkey thereby causing it to get closer to one source, either water or food, and accordingly away from the other. This way the impasse would be instantly broken, and the donkey will be either well fed then well hydrated, or well hydrated, then well fed.

Randomness to make a decision may seem like the opposite of reason or rationale—a form of giving up on a problem, a last resort.

But random outcomes can sometimes be used as a tool to break stalemates.

A man (or a donkey) who sees two options as truly equally compelling cannot be expected to be fully rational.

Sometimes the best solution to a problem is to turn to chance, rather than trying to fully reason out an answer.

In cricket, flipping a coin to help with the decision process of who should bat first is an example of using randomness usefully. This is efficient as long as a coin toss doesn’t influence who would win or lose a match.

In our business, we see it happen regularly with investors.

FDs don’t provide the inflation beating returns and equities are perceived as too risky.

“The markets are too expensive, I will invest when they correct and after the correction, “they will fall further” are the common excuses we hear.” They cannot decide where to invest, they miss the rally and the money remains in the savings account thereby losing the opportunity.

By the way, because I couldn’t decide on which cuisine, and I had to go to bed hungry that night.

Next time my wife puts me in a situation like this, all Iam going to do, is to flip a coin.

Decide either way, don’t miss the opportunity, don’t be a Buridan’s donkey and stay blessed forever.